Two years into the business John wasn’t so sure. He was still working 70-plus hour weeks, still at the mercy of his lead associate, who would decide to go to the beach for some important family “business,” and was staring at pay stubs not half of what he had been earning in corporate America. His confidence has turned into uncertainty.Is all this effort and worry really worth it? Sure, it feels really great to be an entrepreneur, but the dollars have got to work too.

The transition from a “real job,” working for someone else, having defined responsibilities, and receiving a regular paycheck is always enlightening.

The Psychological Commitment Much has been written about, and every franchise self-help book details, the introspective analysis encouraged todetermine if you are “right” for owning your own business –the so-called psychologicalfactor. Franchising addsanother dimension.

There is certainly lessrisk, as stated in the old adage of being in business “for yourself but not by yourself.” But franchising also brings the additional requirement of team and system responsibilities. It means working within the franchisor’s parameters and sharing financial rewards.

If you are right for owning your own small business, the positive emotional aspects are apparent. You are driven by those lifestyle emotions that create the passion that propels you to work each day; pride, ego, a sense of power and control, flexibility, and status. Theyare counterbalanced against the emotional liabilities; risk, hard work and long hours, and some degree of uncertainty.

The Financial Commitment As you formed or entered your business, or perhaps purchased an existing business, you probably did an assessment of the financial requirements to start and operate it. If you were well coached, or had a progressive franchisor, you may even have completed a business plan that detailed the capitalization, cash required for your business, and expected returns from that investment. How are you doing against your proforma? What “returns” are you receiving from your business? What is your business worth to you?

While the effort and the risk of owning a business are often easy to visualize, it is more difficult to envision and quantify the financial remuneration provided by your effort.

When employed, you received a paycheck accompanied by a pay stub. You knew exactly your return for your effort expended. It was an easy and responsiveindication of your contribution and worth. In your own small business, a paycheck is only one of four ways to receive value for your efforts and investment. And, in many ways, it is not even the most efficient or desirable from a taxation standpoint.

How do you receive remuneration and value from a small business?

- W-2 Income:The paycheck is the easiest income to visualize, compare to the past, and calculate the return on investment of both effort and money. Unfortunately it is also the most heavilytaxed. Not only are you responsible for federal and state income tax, but as the owner of the company, you end up paying both sides (employer and employee) of the labor taxes: social security, unemployment, disability, and worker’s compensation. These can combine to add over 28 percent to the cost of payroll dollars. In many cases a conversation with your accountant will reveal methods to transfer income to one of the following

- Standard of Living Items: These are the “legal perks” of owning your ownbusiness. While these purchases must be justified as business expenses to maintain their deductibility, there are many items your business can provide that enhance your standard of living: business surroundings and environment; that new computer you always wanted; 50 percent of meals related to business, and even that new Walt Disney screen saver. These benefits are devoid of all taxes.

- Company Earnings: Profits, or even the cash generated from operations, can take several forms depending on the legal structure of your company. If it is a LLC, Partnershipor Type S Corporation, the number is shown on a form Schedule K-1. If it is a regular C Corporation, you could receive dividends as reported on a form 1099. And if you operate your business as a sole proprietor, the income is shown on the Schedule C of your Form 1040. This income is subject to federal and state income taxes, but is not taxed as payroll and thus has none of the wage taxes associated with W-2 income.

- Increase in Equity: In many businesses this is one of the largest sources of return. Yet because it functions as a “forced” savings plan, the value is not readily apparent. The increase in equity is really the change in fair market value –the theoretical sales price –of your business from year to year. Equity usually is generated from the reduction of business debt and the increase in cash flow provided from operations. Like the equity developing in your home as you make mortgage payments, it cannot be realized until you refinance or sell your business. But it is real dollars, and those dollars are tax deferred until realized, when they are subject only to capital gains tax.

Create a Balance These four methods of return work together to create value within a small business. A balance is created between current (W-2 earnings, standard of living items, company earnings) and long term (equity) items so as to provide the maximum post-tax benefit to the owner, consistent with a desired standard of living. To create the balance, the respective items must be calculated on a regular basis and become a topic of thought and decision.

W-2 income is consistent and easy but very expensive from a tax standpoint. Equity createdby increasing the worth of the business may necessitate sacrificing the current profits. Or even worse, squeezing the business for current profits may cause serious problems with developing and maintaining your long term equity in the business. Being unreasonable with standard of living items will cause problems with the IRS. Know the numbers. Understand how the numbers are generated for your business, and strike a balance.

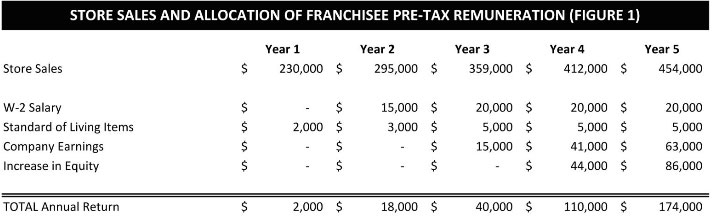

How John Did It Let’s take a look at how John has managed his numbers over the last five years (Figure 1). With a retail store that continues to build over time, and with heavy capitalization requirement and thus extensive debt, John chose to reinvest in the business much of the cash generated during the first several years. This made the family finances tight for the first two years, but allowed him to reduce debt and spend the advertising and marketing dollars necessary to drive sales.

It is easy to see why John doubtedhis decision after two years. He had left a $50,000 per year job, invested $50,000 and borrowed another $200,000 to start his franchise. He was making good choices and developing a business with excellent returns and good equity appreciation, but the sacrifices were today and the return was tomorrow. By having a good business plan, John was able to manage thepsychological as well as the financial commitment.

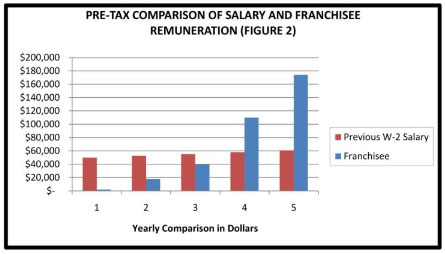

Comparing his returns to his previous salary (Figure 2), John knows why he started a small business. Staying at the “old job,” he may have risen with the normal 5 percent annual increases, to $60,000 orso per year. This year he will benefit over $170,000, and he owns a business with a fair market value in excess of $300,000.

John has learned a lot over the past five years: sales, marketing, personnel issues, operations, and most important, how to maximize his financial benefits from his franchise. Making the business “worth the effort” involves understanding the ways a small business can create value for its owner, know what the numbers are, and balancing those to achieve your objectives and minimize the tax obligations.

Owning a small business can be fun and financially rewarding, but no one said itwould be easy. If it were, there would be a lot more competition.